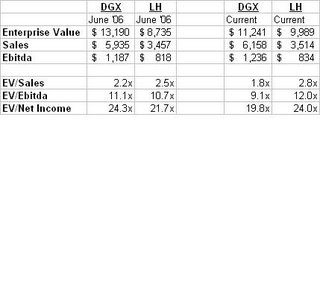

For similar businesses in a commoditized industry (in which DGX is the leader and has historically outperformed LH in) Laboratory Corp is trading at a higher sales multiple (55% premium) and a higher Ebitda multiple (33%). The fact that Laboratory Corp is willing to sacrifice margins and risk its own book of business to engage in a price war does not appear to be priced into the market. Given that Quest is likely to engage in similar guerilla-type market-share theft, I believe a short of Laboratory Corp. makes sense. At the same time, I like the overall industry and believe Quest Diagnostics is trading at a 'slighly' compelling valuation that could be attractive to a private equity buyer (particularly if it fell any further.

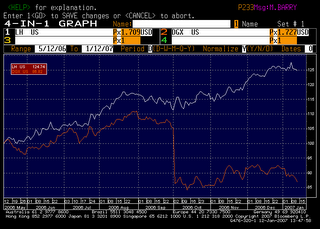

As such, I am recommending a short of LH ($73) and a buy of DGX ($50.10) and have executed this trade for myself and my Oceans-7 account. I am considering selling LH $75 calls and/or buying longer-dated $65 LH puts. Below is a historical spread comparison between the two companies. Note that since 1995, DGX has significantly outperformed LH (in spite of recent drop), which tends to indicate that DGX's near-term underperformance may revert towards the historical average. I have not done any mean-regression analysis, apart from what I can accomplish by eye-balling the chart. This looks like a winner though, as I think the market is reading too much into DGX's loss of a contract with United Healthcare (which accounted for 7% of DGX revenue). The thesis behind the trade idea is, if DGX is in trouble....LH will be too in the not-too-distant future. This has been true for both companies historically.