BUY CSC @$48 range. CSC announced their company was not going to be sold to a buyout group, but that they would be going ahead with a $2bln stock repurchase, which represents 22% of their floated shares. The company is also subject to an options-grant investigation that most companies are facing, but in any event their stock fell 13%...half of which occurred intraday. On a technical basis I think their is support at $48, and additional longer-term support in the $43-45 range. I would have liked to sell the puts, but their options pricing is way too skimpy and doesnt compensate for the risk associated with writing them.

I am recommending putting on a trade position in 1/4 sizes at a time and hope to sell the puts at the right premium level.CSC trades at 4.3x ev/ebitda, vs. the market average valuation multiple closer to 7-8x. Any stock repurchases below $50 should enhance a buyout firm's ability to step back into the picture and pay a larger premium on the remaining shares, so I am fairly positive on the outlook.

I am recommending putting on a trade position in 1/4 sizes at a time and hope to sell the puts at the right premium level.CSC trades at 4.3x ev/ebitda, vs. the market average valuation multiple closer to 7-8x. Any stock repurchases below $50 should enhance a buyout firm's ability to step back into the picture and pay a larger premium on the remaining shares, so I am fairly positive on the outlook.MWY- Short Squeeze Part deux?

MWY is also forming a killer short squeeze, 95% of the floated shares are tied up and Sumner Redstone appears to be moving in tor the kill, buying 1% of the outstanding float per day. Sumner's buying in the single-digits and low-teens in 2005 caused the stock to move from $8 to $24 last year. After he ceased buying MWY stock in the high teens, it has since fallen to $7 (admittedly, the company is a terd). However, since he has restarted stock repurchases in the past two days the stock is up 15% to $8.09. With approximately 2MM shares short and 7.6MM in the float, there is the distinct possibility of a short squeeze into the low double digits... as Redstone owns 85% of the company and is very near the 90% threshold required to take the company private.

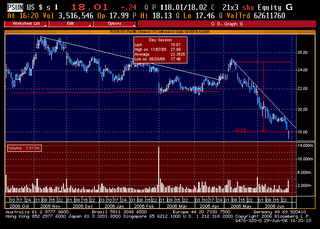

BUY PSUN under $18- continue averaging into position as stock trades down

Am also looking at value in CLE- Claire's Stores (less fashion-sensitive than other retailers), and DG (which is less economically sensitive than other dollar stores and is trading at approximately 12x peak free-cashflow. All of these names are oversold,

PSUN is down almost twenty percent from where I first noted it as being potentially interesting. While I was more concerned after checking out some of their stores, they are now trading at around 4.5x trailing ebitda ( versus 6.5x for the group, which is still below the market at 7.5-8.0x). Essentially, if PSUN's earnings were chopped in half, they would have a P/E of around 21x. While that P/E level is high, for a depressed earnings multiple and worst-case scenario it would seem to indicate that current levels offer a good entry point.

1 comment:

PSUN is at 13? Turd-burgled.

Post a Comment