Thursday, December 27, 2007

Brinker International(ticker symbol EAT) trades at .7x sales and 8.5x trailing operating profit. There seems to be a glut of restaurants in most fast-growing suburban marketplaces, which could be a problem if consumer discretionary income falls off and cost-inflation continues to ramp up. All that being said, Brinker's share price has fallen from $35 to $20...they may not have as much hidden real estate value as Darden owns, but it does own more than 1/4th of its stores and owns some strong concepts in Maggiano's, Chili's, and On-theBorder. Now that I mention it, Darden might be a good buy eventually too....

As the chart above shows (w/green line, Brinker is trading at a historically low Price/Sales multiple, my target would be to see it increase from .55x sales to 1x sales, which would be an increase of 90% from current levels.

Friday, November 02, 2007

Oh Yeah! Bernanke!

As the Federal Reserve continues to throw water onto a grease fire, it seems there are a lot more unknown problems waiting to surface. My theory (stolen from other smart people) is that the subprime scare and current "credit crisis" is a function of too much easy-money and liquidity in the system. Instead, the Fed is acting as if no-money down loans on $500,000 Miami condos to NINJAs (No Income/No Job or Assets) is a worthwhile cause to fight for. The Federal Reserve continues to cut interest rates, which is decimating an already-weak dollar...which is going to really spike inflation (which has already been rising well above 5% per annum- excluding home-price depreciation)

I'm probably silly to be so picky about stocks right now, since this initial inflation surge will likely cause a lot of companies with tangible assets and low Price/Books to be revalued higher...along with rapid price inflation that allows companies to report large earnings increases (that maybe reflect inflation more than true pricing power). The markets focus on a few stocks like GOOG $700+, BIDU $390+, AAPL $180+, AMZN$85+, and RIMM seems silly and highly reminiscent of the nifty-50 from the 1970s. This will probably end with these stocks doubling from their current levels, before falling back to around 50% of their current levels. (Yes, Google, I'm talking about you!)

Current stocks I'm interested in:

AEA-$9, scummy payday lender, trading 5x trailing FCF. Once gas prices hit $4/gallon, people are going to need to borrow against next months paycheck if they want to afford enough gas to get to work.

MHP-$46- Owns S&P and some publishing businesses, 12x trailing FCF, but likely to get hit by scrutiny surrounding their ratings of subprime business etc. I guess i just like pain, at least when this thing goes down 15% on me, I can say that I didnt buy it at the 52-week high at $72.50. S&P makes 40% operating margins on its ratings biz and people will be borrowing money again soon someday, their business is something akin to a toll-collector...a good biz to be in.

LUV-$12.5- Another bad idea, buying Southwest Airlines. Not only won't they do something dumb like LBO, their fuel hedges don't give them a competitive advantage at current high levels. These guys have rapidly increased fares and are no longer a "discount" airline. All the same, low leverage and good service make it worth selling $12.50 puts...it didnt even stay below $12.50 after 9/11... so I doubt mortgage messes or high oil prices will either.

LOJN- $15- Lojack has 25% of their market cap in cash and no debt, 12x trailing FCF but low growth. Stock down from $24/share on worries about new auto sales. Im not super bullish, but selling $15 puts is earning me 3% in exchange for my willingness to buy this stock on a dip...not a bad tradeoff.

MRH-$17- strong insider buying, somewhat risky reinsurer that screwed up badly ahead of Hurricane Katrina, but appears to have recovered and learned its lesson. Earning strong returns, although the P&C market is weakening. Believe the insider buying is a show of confidence in strategy. Also like HCC, which underwrites niche insurance like aviation, bail bonds, etc. and is growing faster.

I'm also watching all the insider buying going on at mortgage insurers, but RDN/MTG/PMI have all continued falling even after the bullish signals. I cant get my hands around where the bottom is, but am torn between waiting to buy the stock or buying a crapload of calls. Banks continue to buy insurance from these guys, so this is one of the areas where returns could potentially be huge. (although 2007-2009 losses might be "huge-er"... is that a word?). If anyone wants to talk mortgage insurance, I've got some thoughts....feel free to share your own.

Friday, August 24, 2007

ISYS is doing a tender offer on its stock at $27 a share. They are a small, $270MM mkt cap tech company with too much cash and a slightly rich stock valuation that has gone nowhere the past five years. Their price is $24.50, I am recommending that you buy 99 shares of the stock at any price under $24.50. The tender offer runs through September 11th, so you just have to notify your broker to submit your shares at $27, with "odd-lot-preference" treatment.

I bought Oceans Seven their 99 shares, and am buying 99 shares for my and Jennys personal accounts. The trick is that no more than 99 shares are registered to each person, that ensures you will get all your shares bought once the tender offer is completed. At $24.50, your gain is $248, less commissions, for about a months investment of $2450..... oh, and if you buy today you will pick up a $6 dividend (woo hoo!) as well.

I bought Oceans Seven their 99 shares, and am buying 99 shares for my and Jennys personal accounts. The trick is that no more than 99 shares are registered to each person, that ensures you will get all your shares bought once the tender offer is completed. At $24.50, your gain is $248, less commissions, for about a months investment of $2450..... oh, and if you buy today you will pick up a $6 dividend (woo hoo!) as well.

Friday, August 10, 2007

SUBPRIME AND CRAMER FOR THE RECORD-

Cramer two weeks ago in mid July....

Cramer now....

I think he gives a pretty accurate picture of the two-faced nature of a lot of these Wall Street guys....they leverage up irresponsibly, then when they wreck the system they want Mommy (or Bernanke) to bail them out. The Colbert followup is hilarious. As it stands, I am currently short an ACS $50 put (that is now in the money) and am at a loss....hope to get "put" the stock, as the potential buyout price on the company is above $60/share (30% premium to current price). Also am long some Broadridge stock and Discover Financial, both hedged with covered calls. Idiots are hoping the Fed will add liquidity to the market so they can get big market rallies....not "save the economy".... sometimes its just annoying to watch the market.

Cramer two weeks ago in mid July....

Cramer now....

I think he gives a pretty accurate picture of the two-faced nature of a lot of these Wall Street guys....they leverage up irresponsibly, then when they wreck the system they want Mommy (or Bernanke) to bail them out. The Colbert followup is hilarious. As it stands, I am currently short an ACS $50 put (that is now in the money) and am at a loss....hope to get "put" the stock, as the potential buyout price on the company is above $60/share (30% premium to current price). Also am long some Broadridge stock and Discover Financial, both hedged with covered calls. Idiots are hoping the Fed will add liquidity to the market so they can get big market rallies....not "save the economy".... sometimes its just annoying to watch the market.

Friday, June 15, 2007

The buyout/LBO-boom has just witnessed its first major casualty....

Ronco, Maker of the Veg-O-Matic, Files for Bankruptcy (Update2)

2007-06-15 13:05 (New York)

(Adds sale of company in third paragraph.)

By Jeff St.Onge

June 15 (Bloomberg) -- Ronco Corp., maker of the Veg-O-Matic

vegetable slicer and Pocket Fisherman, filed for bankruptcy two

years after founder and television pitchman Ron Popeil sold the

company.

Ronco, which marketed products as perfect for ``grads and

dads,'' sought protection from creditors owed more than $32.7

million. It listed $13.9 million in assets in papers filed

yesterday in U.S. bankruptcy court in Woodland Hills, California.

A sale of Ronco ``in the coming weeks is the best and most

viable mechanism for preserving'' the company's value, Chief

Executive Officer John S. Reiland said in the bankruptcy filing.

Reiland said Ronco will be sold through a court-supervised

auction and already has a potential buyer.

Popeil, 72, started the Chatsworth, California-based company

in 1958 and became a household name by hawking products in late-

night television ads. He was known for infomercials selling his

products, and got his start pitching his father's Veg-O-Matic

manual food processor with the phrase: ``It slices! It dices!''

Ronco was sold by Popeil to a holding company, Fi-Tek VII,

in June 2005, according to court papers. The buyer kept the Ronco

name and the right to purchase products Popeil invents before

they are offered elsewhere. He continues to work for Ronco as a

consultant and spokesman.

`But wait, there's more'

Popeil Inventions, owed more than $11.7 million, and other

companies owned by Popeil are listed in court papers as Ronco's

largest creditors. His inventions include a machine that

scrambles eggs inside the shell, a food dehydrator, an automatic

pasta-maker and a spray to cover bald spots on people's heads.

Among the company's best-selling gadgets is the Pocket

Fisherman, a compact rod and reel.

Popeil is listed as an inventor on more than two dozen U.S.

patents, according to the U.S. Patent and Trademark Office. His

fast-paced TV ads added phrases to the lexicon, such as ``But

wait, there's more'' and ``four easy payments.''

Popeil placed Ronco under bankruptcy court protection in

February 1984, and the company stopped doing business until he

resurrected the business with a former company salesman.

Fi-Tek VII's buyout in 2005 left Ronco with about $250,000

cash, Reiland said in court papers. The cash ``problem was

compounded by the fact that Ronco was entering the period where

it required significant working capital in order to acquire

inventory for the busy holiday season,'' he said.

`Wow, That's Terrific Bass!'

Stacia Neeley, Ronco's bankruptcy lawyer, didn't return a

call seeking comment. Popeil didn't return a message left with

his assistant.

In August, Ronco fired President and Chief Executive Officer

Richard Allen. He was replaced by Reiland, who first joined the

company in June 2005, according to court papers.

Ronco shares, which peaked at $2.60 in June 2006, almost

doubled, jumping 6 cents to 13 cents at 9:30 a.m. in over-the-

counter Bulletin Board trading.

Ronco's television ads were so familiar to viewers that they

were spoofed by comedian Dan Aykroyd in a famous 1976 sketch on

the television program ``Saturday Night Live.'' In the sketch,

Aykroyd advertises the ``Super Bass-O-Matic '76'' by ``Rovco,'' a

blender that turns a whole fish into a brown liquid, which is

then drunk by Laraine Newman, who co-starred in the segment.

``Wow, that's terrific bass!'' she says.

The case is In re Ronco Corp., 07-12000, U.S. Bankruptcy

Court for the Central District of California (San Fernando

Valley).

--With reporting by Anthony Aarons in London, Susan Decker in

Washington and Bob Van Voris in New York. Editor: Rovella

Ronco, Maker of the Veg-O-Matic, Files for Bankruptcy (Update2)

2007-06-15 13:05 (New York)

(Adds sale of company in third paragraph.)

By Jeff St.Onge

June 15 (Bloomberg) -- Ronco Corp., maker of the Veg-O-Matic

vegetable slicer and Pocket Fisherman, filed for bankruptcy two

years after founder and television pitchman Ron Popeil sold the

company.

Ronco, which marketed products as perfect for ``grads and

dads,'' sought protection from creditors owed more than $32.7

million. It listed $13.9 million in assets in papers filed

yesterday in U.S. bankruptcy court in Woodland Hills, California.

A sale of Ronco ``in the coming weeks is the best and most

viable mechanism for preserving'' the company's value, Chief

Executive Officer John S. Reiland said in the bankruptcy filing.

Reiland said Ronco will be sold through a court-supervised

auction and already has a potential buyer.

Popeil, 72, started the Chatsworth, California-based company

in 1958 and became a household name by hawking products in late-

night television ads. He was known for infomercials selling his

products, and got his start pitching his father's Veg-O-Matic

manual food processor with the phrase: ``It slices! It dices!''

Ronco was sold by Popeil to a holding company, Fi-Tek VII,

in June 2005, according to court papers. The buyer kept the Ronco

name and the right to purchase products Popeil invents before

they are offered elsewhere. He continues to work for Ronco as a

consultant and spokesman.

`But wait, there's more'

Popeil Inventions, owed more than $11.7 million, and other

companies owned by Popeil are listed in court papers as Ronco's

largest creditors. His inventions include a machine that

scrambles eggs inside the shell, a food dehydrator, an automatic

pasta-maker and a spray to cover bald spots on people's heads.

Among the company's best-selling gadgets is the Pocket

Fisherman, a compact rod and reel.

Popeil is listed as an inventor on more than two dozen U.S.

patents, according to the U.S. Patent and Trademark Office. His

fast-paced TV ads added phrases to the lexicon, such as ``But

wait, there's more'' and ``four easy payments.''

Popeil placed Ronco under bankruptcy court protection in

February 1984, and the company stopped doing business until he

resurrected the business with a former company salesman.

Fi-Tek VII's buyout in 2005 left Ronco with about $250,000

cash, Reiland said in court papers. The cash ``problem was

compounded by the fact that Ronco was entering the period where

it required significant working capital in order to acquire

inventory for the busy holiday season,'' he said.

`Wow, That's Terrific Bass!'

Stacia Neeley, Ronco's bankruptcy lawyer, didn't return a

call seeking comment. Popeil didn't return a message left with

his assistant.

In August, Ronco fired President and Chief Executive Officer

Richard Allen. He was replaced by Reiland, who first joined the

company in June 2005, according to court papers.

Ronco shares, which peaked at $2.60 in June 2006, almost

doubled, jumping 6 cents to 13 cents at 9:30 a.m. in over-the-

counter Bulletin Board trading.

Ronco's television ads were so familiar to viewers that they

were spoofed by comedian Dan Aykroyd in a famous 1976 sketch on

the television program ``Saturday Night Live.'' In the sketch,

Aykroyd advertises the ``Super Bass-O-Matic '76'' by ``Rovco,'' a

blender that turns a whole fish into a brown liquid, which is

then drunk by Laraine Newman, who co-starred in the segment.

``Wow, that's terrific bass!'' she says.

The case is In re Ronco Corp., 07-12000, U.S. Bankruptcy

Court for the Central District of California (San Fernando

Valley).

--With reporting by Anthony Aarons in London, Susan Decker in

Washington and Bob Van Voris in New York. Editor: Rovella

Monday, March 05, 2007

DGX-LH long-short trade closed out

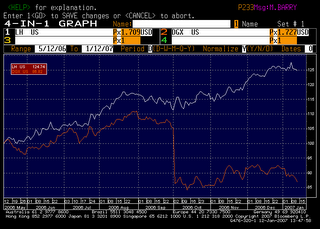

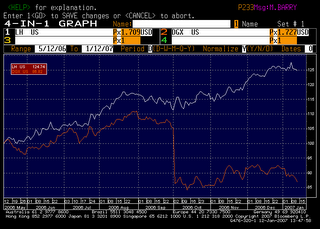

The chart indicates the approximate gain, although the ride has been a bit more volatile than I had expected when i got into the trade. The original thesis was that DGX was 25% undervalued versus Labcorp, but Quest lost a second major contract (following UNH loss) that made me question their aggressiveness in their core lab business. As originally predicted, Quest Diagnostics picked its skirt up from around its ankles and got back to work, with the recent announcement that LH would no longer be serving as Aetna's in-network lab provider.

This helps Quest marginally, but more importantly signals the potential for a major price war, which could hurt both companies longer term (fighting for market share, cutting each others throats). Quest will probably still be a good long-term investment at these levels, but I have decided to speculate a bit and close out both sides of the trade. Net-net, I exited DGX around a 1/2% loss, and LH at a 7.5% gain. I'm sure the trade levels will continue to collapse, but will look to re-enter DGX within the next month or two hopefully.

The chart indicates the approximate gain, although the ride has been a bit more volatile than I had expected when i got into the trade. The original thesis was that DGX was 25% undervalued versus Labcorp, but Quest lost a second major contract (following UNH loss) that made me question their aggressiveness in their core lab business. As originally predicted, Quest Diagnostics picked its skirt up from around its ankles and got back to work, with the recent announcement that LH would no longer be serving as Aetna's in-network lab provider.

This helps Quest marginally, but more importantly signals the potential for a major price war, which could hurt both companies longer term (fighting for market share, cutting each others throats). Quest will probably still be a good long-term investment at these levels, but I have decided to speculate a bit and close out both sides of the trade. Net-net, I exited DGX around a 1/2% loss, and LH at a 7.5% gain. I'm sure the trade levels will continue to collapse, but will look to re-enter DGX within the next month or two hopefully.

Sunday, February 25, 2007

Another Day, Another buyout... for those not keeping track at home, Florida Rock and Hydril have both been bought out at massive premiums versus my recommendations (to buy) that were made within the past six months in this blog. FRK is trading at $68 (up 58% from my $43 reco. price in Oct. 2006 and 78% from my buy-in price) and HYDL is trading at $95 (up 86% from my $51 buy-in price). They have been bought at heavy premiums above what the public market value would have reached, but reflective of the control premium that a private owner would be willing to pay to acquire these high quality franchises. Unfortunately, I unloaded most of my stock in both names after I had made 25% and 41% in the respective names. I have had more annoying problems in my life than selling at a 40% gain within a one month period though!

I continue to like $2-5Bln market cap companies, but have lately been looking at some slightly larger entities that also represent high quality businesses with strong brands and franchise quality. Several of these names are trading just above levels where I would consider them to be cheap. For instance, SAIC(federal IT/professional-services contractor-$18.50) and MRH(Bermuda reinsurance-$17.70) are names that I like. SAIC's main business risk is political, in the form of potential Democratic meddling with Federal outsourcing.... MRH's is hurricanes and nonsense like Florida's restructuring of its excess-of-loss reinsurance pricing.

In spite of these risks, MRH is increasing its book value by 15-20%/year and trades at 1.1x book value, with one of the best underwriters as its CEO and a more conservative risk policy (which is why book value isnt going up even faster). SAIC is not "cheap" per se, on an earnings basis, given its nearly 20x forward earnings, but this is one of those beauties that earns more in free-cashflow than it reports in earnings, due to the amortization of fixed-contract costs that are incurred up-front. Given that nearly 22,000 of their 45,000 employees have high-level security clearances (tough to acquire), this gives them a reasonable barrier to entry. On a FCF basis SAI earns above a 5% yield and should improve this figure now that it is a public company. On both companies I have bought a small amount of stock and sold out of the money calls. In addition, I have sold $17.50 puts going out to April for a 3% implied yield-to-put (22% annualized return, assuming I am not put any stock). If either SAI/MRH falls below $17.50 I would be okay owning these entities for the long-term, based on my current view of management and the companies.

I do not think either of these companies will be acquired by private equity, although SAI would be extremely attractive in an LBO if it were to fall much below $17.50....so I am not expecting a grand slam like FRK/HYDL to occur. The market appears frothy with too many things hitting 52 week highs, companies that people were shunning back in July. (PS- If I am not "put" any MRH/SAI, would look to roll and sell forward additional contracts, although MRH should carry a huge premium through the summer if you think hurricane season migh pick up).

I continue to like $2-5Bln market cap companies, but have lately been looking at some slightly larger entities that also represent high quality businesses with strong brands and franchise quality. Several of these names are trading just above levels where I would consider them to be cheap. For instance, SAIC(federal IT/professional-services contractor-$18.50) and MRH(Bermuda reinsurance-$17.70) are names that I like. SAIC's main business risk is political, in the form of potential Democratic meddling with Federal outsourcing.... MRH's is hurricanes and nonsense like Florida's restructuring of its excess-of-loss reinsurance pricing.

In spite of these risks, MRH is increasing its book value by 15-20%/year and trades at 1.1x book value, with one of the best underwriters as its CEO and a more conservative risk policy (which is why book value isnt going up even faster). SAIC is not "cheap" per se, on an earnings basis, given its nearly 20x forward earnings, but this is one of those beauties that earns more in free-cashflow than it reports in earnings, due to the amortization of fixed-contract costs that are incurred up-front. Given that nearly 22,000 of their 45,000 employees have high-level security clearances (tough to acquire), this gives them a reasonable barrier to entry. On a FCF basis SAI earns above a 5% yield and should improve this figure now that it is a public company. On both companies I have bought a small amount of stock and sold out of the money calls. In addition, I have sold $17.50 puts going out to April for a 3% implied yield-to-put (22% annualized return, assuming I am not put any stock). If either SAI/MRH falls below $17.50 I would be okay owning these entities for the long-term, based on my current view of management and the companies.

I do not think either of these companies will be acquired by private equity, although SAI would be extremely attractive in an LBO if it were to fall much below $17.50....so I am not expecting a grand slam like FRK/HYDL to occur. The market appears frothy with too many things hitting 52 week highs, companies that people were shunning back in July. (PS- If I am not "put" any MRH/SAI, would look to roll and sell forward additional contracts, although MRH should carry a huge premium through the summer if you think hurricane season migh pick up).

Wednesday, February 07, 2007

Site of the Month- Check out http://valuediscipline.blogspot.com/

They had a pretty good writeup several days ago on MMM. From what I can tell, this company generates nearly $4.5Bln in normalized cashflow from operations, approximately $3.5Bln actual cashflow (due to working capital expenses) and nets out to $2.5Bln actual free cashflow per year. This assumes continued R&D and growth expenditures, however on lower growth assumptions this company trades at 16x free-cashflow in a low growth scenario, for a 6.25% free cashflow yield. While not the sexiest yield in the world, people have historically paid a lot more for this company's earnings...which have continued to increase in the face of a flattish/declining stock price over the past few years. The chart below tracks the company's stock price (white line) vs. its P/E (green line). MMM is under-levered ("AA" credit rating) and appears to be somewhat cheap on an absolute basis, but very cheap on a relative basis (versus its historical trading range). It is difficult to gauge competitive threats and how much LCD pricing will hurt some of their film divisions, so I am just buying a half position and watching it. This is more of a long-term IRA stock.

Friday, January 12, 2007

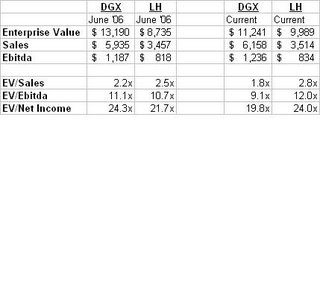

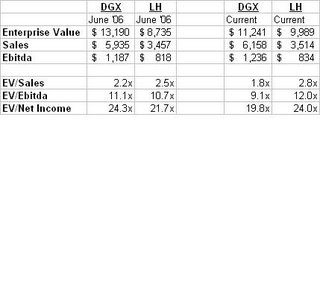

Quest For The Championship? Although the Bears playoff game on Sunday is probably the Quest most sane people are focused on, I have noticed a disturbing discrepancy between Quest Diagnostics(DGX) and Laboratory Corp.(LH) valuations. The discrepancy has arisen from LH bidding aggressively on DGX contracts. Both companies run diagnostic lab/testing facilities and are the largest players in their industry. Vital stats are below.

For similar businesses in a commoditized industry (in which DGX is the leader and has historically outperformed LH in) Laboratory Corp is trading at a higher sales multiple (55% premium) and a higher Ebitda multiple (33%). The fact that Laboratory Corp is willing to sacrifice margins and risk its own book of business to engage in a price war does not appear to be priced into the market. Given that Quest is likely to engage in similar guerilla-type market-share theft, I believe a short of Laboratory Corp. makes sense. At the same time, I like the overall industry and believe Quest Diagnostics is trading at a 'slighly' compelling valuation that could be attractive to a private equity buyer (particularly if it fell any further.

As such, I am recommending a short of LH ($73) and a buy of DGX ($50.10) and have executed this trade for myself and my Oceans-7 account. I am considering selling LH $75 calls and/or buying longer-dated $65 LH puts. Below is a historical spread comparison between the two companies. Note that since 1995, DGX has significantly outperformed LH (in spite of recent drop), which tends to indicate that DGX's near-term underperformance may revert towards the historical average. I have not done any mean-regression analysis, apart from what I can accomplish by eye-balling the chart. This looks like a winner though, as I think the market is reading too much into DGX's loss of a contract with United Healthcare (which accounted for 7% of DGX revenue). The thesis behind the trade idea is, if DGX is in trouble....LH will be too in the not-too-distant future. This has been true for both companies historically.

For similar businesses in a commoditized industry (in which DGX is the leader and has historically outperformed LH in) Laboratory Corp is trading at a higher sales multiple (55% premium) and a higher Ebitda multiple (33%). The fact that Laboratory Corp is willing to sacrifice margins and risk its own book of business to engage in a price war does not appear to be priced into the market. Given that Quest is likely to engage in similar guerilla-type market-share theft, I believe a short of Laboratory Corp. makes sense. At the same time, I like the overall industry and believe Quest Diagnostics is trading at a 'slighly' compelling valuation that could be attractive to a private equity buyer (particularly if it fell any further.

As such, I am recommending a short of LH ($73) and a buy of DGX ($50.10) and have executed this trade for myself and my Oceans-7 account. I am considering selling LH $75 calls and/or buying longer-dated $65 LH puts. Below is a historical spread comparison between the two companies. Note that since 1995, DGX has significantly outperformed LH (in spite of recent drop), which tends to indicate that DGX's near-term underperformance may revert towards the historical average. I have not done any mean-regression analysis, apart from what I can accomplish by eye-balling the chart. This looks like a winner though, as I think the market is reading too much into DGX's loss of a contract with United Healthcare (which accounted for 7% of DGX revenue). The thesis behind the trade idea is, if DGX is in trouble....LH will be too in the not-too-distant future. This has been true for both companies historically.

Subscribe to:

Comments (Atom)