You might be interested in checking out CRF(see also CLM), a closed end fund that trades at 170% of its NAV (was 190% recently before a drop). It owns a bunch of Dow stocks as its top holdings (nothing special) and is only 85% invested. The kicker is that the fund carries a current yield of +11.5%, which equates to paying out nearly 21% of its NAV. Clearly this is not the modus operandi of a "going concern" closed end fund, however the meat of the story appears to originate with the fund's largest holder Ron Olin and his relationship with Doliver Capital and a firm called "Deep Discount Advisory"....oh the irony! My best guess is that these firms are engaged in selling shares of CRF to small investors in cash/retirement type accounts where they cannot be margined. There is a distinct lack of large holders, with the thirteen largest stockholders (behind Ronald Olin and related entities) holding a mere 2% of the outstanding shares. Thus, there are no shares to borrow for a short position against this overvalued asset, which is a shame since there appears to be an obvious incentive for Mr. Olin to market his overpriced stock to unwitting investors, who are no-doubt focused on the current yield of the fund (rather than the all-important NAV).

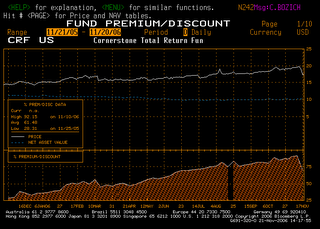

This essentially amounts to selling people a one dollar bill for $2, not exactly a fair trade...especially when you consider the distinct lack of special assets in the fund. Note, being 15% invested in cash has not stopped the fund manager from charging fees on the assets under management. To put it another way, in the chart below, figure that the "white line" should be trading somewhere south of the "blue line"...which implies a 40% plus drop is in the cards for this turkey sometime in the near future (assuming the Dow Jones average does not double...in which case it could remain flat!)

Thought given your position this might be worth passing along, as this would be an excellent case where short sellers would be able to save future investors from "getting their faces ripped off" by Mr. Olin. Note, I am short zero shares due to the clever scheme that has been set up here. (PS- note that CRF is a long-dated fund that traded at a discount prior to the 2000's, but since undergoing manipulative marketing it has been on a rollercoaster ride)

No comments:

Post a Comment