William Lyons Homes (WLS)

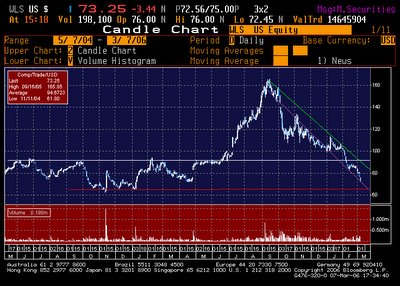

William Lyons Homes (WLS)WTF? ANOTHER HOMEBUILDER? You have got to be kidding me. If that isn't enough, its one exposed wholly to southern/northern California, Nevada (read, Vegas), New Mexico, and Arizona... the juiciest and diciest markets going. Anyway, to the point, Last year, General William Lyons (yes, the Chairman is a general!) made a formal tender offer to acquire the 48% of the company he doesn't own at a price of $82/share. This caused the stock to jump and promptly run all the way up to $160/share. Currently, at $73 and change the stock is well below the previous takeout price... which doesn't reflect the earnings the company has generated the past few quarters. Last quarter, the company turned in $10/share, which would put it at 7x last QUARTER'S earnings!

Before I get too excited and start talking in all caps, this company does have a fair amount of long-dated debt ($620MM net debt vs. $633MM market cap) and forward 2006 earnings are supposed to be $14-15/share (per lowered co. guidance, which could be tenuous given their >25% cancellation rate for existing orders). Still, "the General" has been building homes for more than thirty years and seen enough cycles to have known something like this might happen. My guess is that a buyout could still come, particularly given that another insider owns 23% of the company which leaves a very small float out there(2.2MM shares out of 8.6MM outstanding). Interestingly, .67MM shares are short, which represents 30% of the float and would seem to be a dangerously high short position for a company with easy "takeout potential". Also, WLS could be a takeover candidate for a larger homebuilder looking to gain exposure to the "zoned zone" and juicy southwest real estate markets while gaining the benefit of WLS' pre-existing balance sheet leverage.

Recommend buying 1/3rd of position in low 70's and buying more if it dips to the mid 60's. Although a smaller, highly geared homebuilder concentrated in hot markets is a bit risky, I believe the takeover potential is too high with this company and the slightest change in builder sentiment may cause a short squeeze.

http://stockcharts.com/gallery/?wls

No comments:

Post a Comment