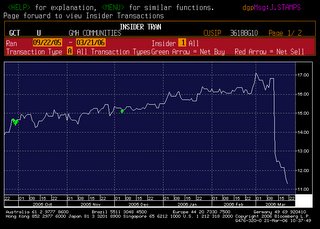

GCT- GMH Communities Trust $11.18

For much of 2005, GMH was the subject of strong insider buying, by multiple officers and directors. In addition, Vornado Realty Trust even bought 700K shares in the company's September secondary offering at $14.25/share. GMH is a REIT focused on college-student-housing and military family-housing. Based upon increased college enrollments and military base realignments, there is decent demand for both of these sectors and GCT has a number of projects in its backlog.

The chart below shows the dramatic dropoff in the share price, which reflects the CFO (was not an insider buying the stock) having written a letter to the board-of-directors whining about a "tone at the top", whatever the hell that means. Presumably, the top management was pushing the CFO to be aggressive, but not do anything illegal (so says the company's internal investigation). From what I see, they adjusted pro-forma earnings down about 10% for the year, but made no adjustments to cashflow for 2005 (which is the important item to watch).

http://finance.yahoo.com/q/bc?s=GCT&t=6m

So why am I looking at this name if there is potentially aggressive accounting? 1) There have been no problems identified at any of the company's properties/developments that I am aware of. 2) Company insiders were buying the stock at much higher prices, including the CEO that was purportedly pressuring lower level management to be overly aggressive. 3) Subsequent to this "tone at the top" letter being disclosed, it appears that the CEO upped his stake to 1.2MM shares and issued a 13D filing that indicated he may make an offer for the whole company (it also implied that he had "shared voting rights" covering an additional 5.8MM shares, which implies that GCT's largest holder, Cohen & Steers, is supporting his prospective bid for the company).

Recommendation? Maybe dip your toe in for a few shares... like most REITS now, this is trading well above book value, yields an 8% dividend and trades around 12x FFO... implying that an 8-9% dividend is sustainable in the event the company is not bought out. (current yield is 8.14%). I believe the CEO is seriously considering buyout the company, however I'd put only a 50/50 probability on this occuring, given the serious disclosure /sarbanes-oxley issues that might be brought up by those investors currently underwater.... (unless the buyout were to come at $15...which is just rampant speculation)

No comments:

Post a Comment