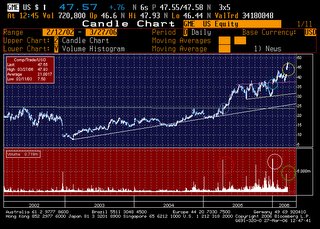

I originally wanted to buy Gamestop back at $19.50, on decent valuation(EV/Sales<.8x, P/E<20x), modest growth targets (10%/year), and a decent chart buildup....that was back in mid-2005, literally the day before they agreed to buyout Electronics Boutique.

This has added nearly $1Bln in debt to the balance sheet, but has also leveraged the company's sales and profitability as well. In all, the company's sales have roughly doubled while their enterprise value (mkt.cap+debt-cash) has nearly quadrupled since their April quarter-end.

Ironically, the historical Gamestop operations would have generated $260MM Ebitda versus the $1.15Bln Ent. Value (at 04/30/05), or roughly 4.4x!!!! A lot of the earnings upside has been driven by trading in used games and movies, versus new consoles and new software sales (which have significantly lower gross margins attached). Ironically, the Electronics Boutique acquisition ($1.2Bln) reduced overall earnings, even after eliminating the one-time merger expenses.

So where does that leave me??? Well, GME has outperformed largely due to arbitraging the used video game market against the likes of Electronic Arts, which has responded by cutting prices on newer video games (i.e- Godfather released at the $39.99 price point). It certainly appears that BBI/MOVI are too disorganized and "grabass-tic" to effectively compete in used video games, however I do see potential negative catalysts for both EA and GME. Namely, lower new-game prices will shrink margins on used-game and new-game sales, while the upcoming launch of PS3 and current XBOX 360 release should result in lower sales of existing PS2/Xbox inventory. While earnings have remained strong to date, the significant inventory growth (+150%) could be difficult to deal with in late 2006. For now, Electronic Arts (EA) appears to be the more compelling short, as it is getting squeezed by GME and has consistently missed earnings over the past 18 months (not to mention, it trades at a higher valuation). Both of these companies should be viewed as potential shorts...particularly when you hear analyst comments about them being properly valued at 25x 2010 Earnings(which also conveniently assumes customers are buying all their games at $59.99/title)

No comments:

Post a Comment