Pat Riley- "Giving yourself permission to lose guarantees a loss. "

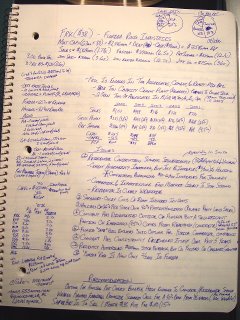

Florida Rock rallied 15% on Friday (at the high of the day), before finishing up around +8%. I continue to own this position, which performed this rally on NO news and no earnings announcements. The key driver of the stock gain appears to be a buyout offer that Cemex launched to acquire Rinker. The buyout offer values Rinker at nearly 10x Ebitda, while at the same there is a private equity push at TXI (Texas Industries) , which is also trading above 10x Ebitda. While Florida is not currently considered the "hottest" residential housing market around... it has historically rebounded and still holds a lot of what can't be rebuilt on the prairie (namely, waterfront property).

Florida Rock is only about 40% exposed to the residential market in Florida, due to its diversification in the Southwest and maintains a very strong balance sheet, with negative net debt. At 7x Ebitda (trailing), its hard to want to sell this stock on a 15% up-day in trading, especially when one considers the chronic cement shortages that have plagued builders in that state for the past three years (state is a net importer). Perhaps I'm being greedy, but historically selling (too soon) good companies as they start to overcome investor pessimism has been my weakness. I would expect to see this stock approach the $50-55 area within the next few months, if only to move in-line with where other cement/aggregate companies are valued at in the marketplace.

Long FRK (up to $43, from purchase price at $38)- Writeup from Sept. 06 Journal below

No comments:

Post a Comment