G. Gerswhin-" Life is a lot like jazz... It's best when you improvise"

Sold the $15 November Put (20 days to expiration) for $.30/share. Net of commission, this amounts to a target return of 2.0% on my $14.71 VAR (value-at-risk). This amounts to an annualized rate of return of 35% on VAR that is invested in one of the best airlines EVER. I could cite labor costs, lack of strikes, no bankruptcy, consecutive years of profitability, hedged fuel costs below $40/bbl of oil, its own reality television show, but instead I think the most telling feature is that Southwest manages to accomplish its historical profitability without compromising on customer service (i.e- they still give out peanuts and an ENTIRE can of soda), unlike those bastards at other airlines.

The stock is at a 52-week and multi-year low, while I think it could have near-term downside to the mid $14 area, it should have some support at current levels...particularly given that the company has been earnings money the past five years and trades at a lower valuation than it did then...

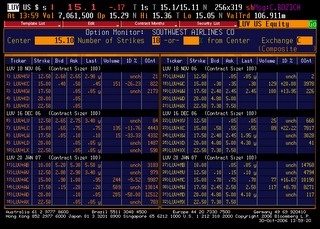

Here is a chart-printing of the option. If you prefer to own the stock, but want a yield higher than Southwest's meager .12% payout (perhaps the major chink in the LUV bull argument), you can always write the $15 call. Again, these strategies only make sense if you have ultra-low commissions(similar to Southwest's ticket prices)

Is free peanuts a valid investment thesis? (The answer to that rhetorical question is yes, in case you didn't know). Look what happened to Lone Star Steakhouse when they removed the peanuts from their restaurant. There were some other problems with sales and earnings, which were probably due to the lack of peanuts I imagine.

No comments:

Post a Comment