Have noticed that some of these bank stock options are not paying close attention to the dividends on the underlying stock, too focused on volatility numbers, etc.

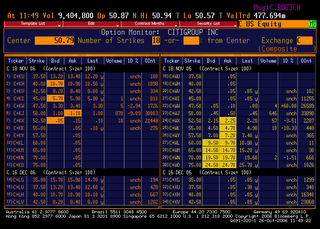

Here is the trade, sold $45 November calls on Citigroup @$5.80, while buying the stock at $50.80. If Citigroup closes above $45 (or does not fall 13%) by November 18th, then this trade will net me $50.80 per share, versus my cost basis of $50.80. Not a great-sounding trade you say? Lest I forget, Citigroup will pay a dividend to holders of the stock on November 6th.... of $.49/share.... which is really all you get out of the trade.

So doing the math, we are really only risking that the stock falls below $45, with that being our net investment in the trade. For a 23 day holding period then, we will earn ($.49-.02 commissions)/$45 at-risk =1.04%,annualized gain*(365/23 days)=16.5%

No comments:

Post a Comment